During the month of June, the Indiana State Department of Agriculture will accept submissions for the 17th annual Indiana Agriculture Photo Contest. The contest is open to all Indiana residents and was created to recognize the hard work and contributions of Hoosier farmers, as well as the beauty of the state’s agricultural landscape.

“Each and every Hoosier is welcome to submit an entry to the contest,” said Lt. Gov. Suzanne Crouch, Indiana's Secretary of Agriculture and Rural Development. “No matter the camera equipment you own, we encourage you to submit your best images showcasing Indiana agriculture.”

Participants are encouraged to submit photos reflecting the wide array of agriculture. The categories photos can be entered under are:

- On the Farm: Showcasing any building, piece of equipment or activity that is a part of life on an Indiana farm.

- Faces of Agriculture: Featuring those who grow and produce food, fuel and fiber in Indiana.

- Agritourism: Spotlighting Indiana’s seasonal and agricultural destinations, such as orchards, wineries and farmers markets.

- Conservation: Highlighting Indiana’s natural beauty with landscapes, water and wildlife.

In total, ten winners will be selected: two from each category and two overall. Winners will be invited to attend a special ceremony at the Indiana State Fair, where they will be recognized and receive certificates from Lt. Gov. Crouch and Indiana State Department of Agriculture Director Don Lamb. Contest winners will also have their photographs featured in the offices of the Lt. Governor’s Family of Business in Indianapolis throughout the year.

“Indiana agriculture is a beautiful thing and we are blessed to be surrounded by so much of it,” Lamb said. “I look forward to seeing how that beauty is captured in this year’s contest."

Contestants can submit up to five photos in digital format accommodated by a submission form for each photo. Photos will be evaluated based on creativity, composition and category representation. Entries must be submitted by 5:00 p.m. (ET) on June 30, 2024.

Click here for entry forms, guidelines and criteria or visit ISDA.IN.GOV

The SWAG (See What Ag. Gives) Team invites all Washington County farmers and agribusiness people to the 2024 Agriculture Hall of Fame program, dinner, and award presentation on Wednesday, June 19, in the livestock show arena at 5 p.m.

Farmers and agribusiness people that RSVP with the Purdue Extension – Washington County office at 812-883-4601, check-in with the SWAG table near the show arena, and attend the Ag. Hall of Fame award program will receive a meal and a coupon for a free ice cream from the Washington County 4-H Clover Creamery.

Participation is limited to the first 200 RSVP’s. The SWAG Team hopes many will join them to honor a deserving Agriculture Hall of Fame recipient, enjoy delicious food, and support youth during 4-H Recognition Night.

It is the policy of the Purdue University Cooperative Extension Service that all persons have equal opportunity and access to its educational programs, services, activities, and facilities without regard to race, religion, color, sex, age, national origin or ancestry, marital status, parental status, sexual orientation, disability or status as a veteran. Purdue University is an Affirmative Action institution.

This informal report by the Division of Entomology & Plant Pathology is a commentary on insects, diseases, and curiosities division staff encounter on a week-to-week basis. Comments and questions about this report are welcome and can be sent to your respective Inspector.

Our Website

Inspector Territories

Eric Bitner (Nursery Inspector & Compliance Officer) -

Be on the lookout for spotted lanternfly. Nymphs have emerged across the state. For an up-to-date map of known locations of spotted lanternfly within Indiana use this link:

experience.arcgis.com/experience/7b5fd32790554abfbf2e8f0cf464fa31.

If you have a report to make of potential spotted lanternfly within that map you can make a report or use this link: survey123.arcgis.com/share/63ac4fc9fce041188873af243d8ab43e.

Eric Biddinger (Nursery Inspector & Compliance Officer) -

First spotted lanternfly first instar nymph found in Elkhart County. Nymphs can be a little tricky to find as they feed on the newer branches. This often puts them up higher in the canopy if there is not a lot of new growth or suckers at ground level.

Kallie Bontrager (Nursery Inspector & Compliance Officer) -

I had the chance to inspect greenhouses and some garden centers in my territory last week. I have been pleasantly surprised with how clean the greenhouses have been. Due to the cloudy and rainy weather I was expecting to see more disease issues such as Botrytis and powdery mildew. While I did see Botrytis on the normal suspects (begonia, geraniums, and impatiens), it was very localized. I saw thrips on spikes, eggplant, gerbera daisy, verbena, and calla lily. A few spider mites were seen on banana, spikes, dahlia, mandevilla and butterfly bush. I found one painted lady caterpillar on a hollyhock which is one of the hosts for that caterpillar.

Kristy Stultz (Nursery Inspector & Compliance Officer) -

Roses are red and covered in slugs? As the weather warms up, so have rose slug sawflies. The larvae themselves may go unnoticed, but the damage is unmistakable. It doesn’t take many to do quite a bit of damage, and at least in my own garden, populations seem to be fairly high right now. Fortunately, these are the European roseslug sawfly (Endelomyia aethiops) that produces only a single generation per year. Now is the time to manage next year’s population before the larvae drop to the ground to pupate. Adults emerge in early spring to lay eggs on the underside of host material.

Caydee Terrell (Nursery Inspector & Compliance Officer) -

Will Drews (Nursery Inspector & Compliance Officer) -

I’ve been seeing a lot of gall-forming mite activity recently in the landscape and nurseries in my area on a variety of trees. Gall-forming mites are in the Gall Mite Family (Eriophyidae). They are microscopic little mites that feed on developing leaves of generally tree and shrub species early in the season and are often host specific to one genus or species of plant. As the adults feed on the leaves, they release growth regulators that induce the formation of interesting gall structures on the leaf surfaces.

The reason for this is two-fold: first, they get nutrients from the inner tissue in the galls, and second, they get protection from predators and environmental conditions. Then, the adult mites lay eggs in the galls and die. The next generation develops within the galls for a couple of weeks and then exit as adults. This cycle will continue until the tree stops producing new leaves for the season, generally sometime in summer. Thus, depending on the year and growing conditions, there can be several generations of gall mites in a single growing season. Once conditions are undesirable for creating new galls, the mites will find a protected spot to overwinter.

Generally speaking, the damage caused by gall mites (aka eriophyid mites) is more of a cosmetic issue than an issue actually causing serious harm to the plants. Populations of eriophyid mites fluctuates season to season and established trees should be fine without any control. However, large populations and damage on tree seedlings and newly planted trees may warrant some control. Damaged leaves can be handpicked and removed before the mites emerge or preventative treatments may be applied during the dormant season to the overwintering mites before they create the galls.

The following photos show some of the gall mites I’ve come across recently.

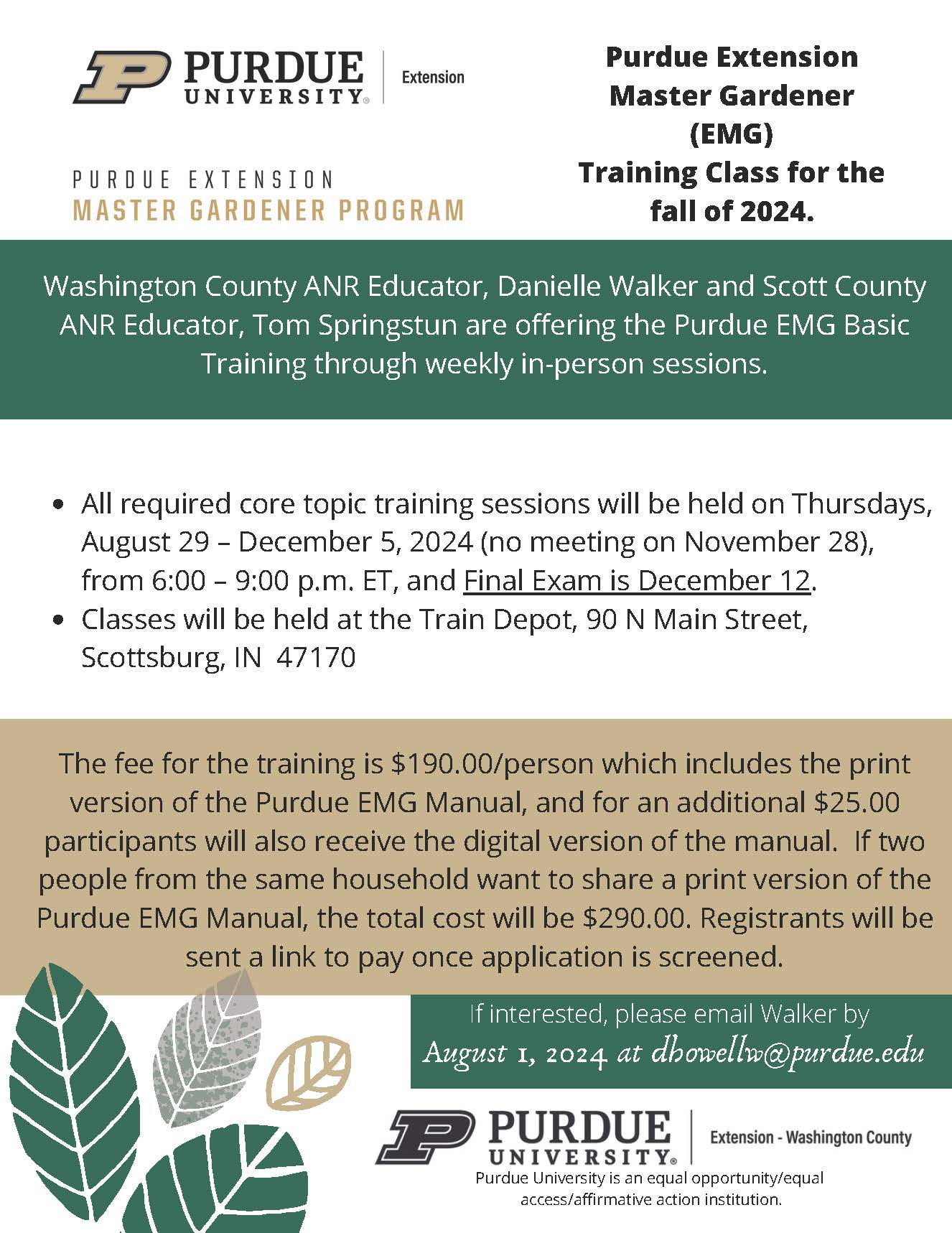

Purdue Extension in Scott and Washington Counties are seeking participants for the joint Purdue Extension Master Gardener (EMG) Training Class for the fall of 2024.

The fall 2024 Purdue EMG Basic Training includes weekly in-person sessions on Thursdays, August 29 – December 5, 2024 (no meeting on November 28 due to the Thanksgiving holiday), from 6:00 – 9:00 p.m., with the final exam on December 12. The weekly sessions are held at the Train Depot (90 N. Main St., Scottsburg).

The training fee is $190.00/person, which includes the print version of the Purdue EMG Manual, and for an additional $25.00, participants can receive the digital version of the manual. If two people from the same household want to share a print version of the Purdue EMG Manual, the total cost will be $290.00.

If interested, please contact Danielle Walker at

See the attached packet for more information and the EMG application.

Scott-Washington EMG Training Info. Packet

INDIANAPOLIS (May 15, 2024) —Indiana landowners, for the second year in a row, set a record in the number of conservation practices to maintain soil health, according to the Indiana Conservation Partnership (ICP).

The ICP, which works with Hoosier landowners to provide technical or financial assistance for the implementation of conservation projects, recently announced its 2024 conservation accomplishments. In 2023, landowners supported by the ICP installed more than 50,000 new conservation practices, up 3,000 from 2022. Last year’s 47,000 conservation practices installed was also a record.

“Year after year Hoosier farmers and conservationists are installing additional stewardship practices and working hard to ensure nutrients and irreplaceable topsoil stay on their fields,” said Lt. Gov. Suzanne Crouch, Indiana’s Secretary of Agriculture and Rural Development. “Breaking records year after year is no small feat, and I want to thank the partners in this program and also the landowners and farmers for their contributions and wish them well on their continued success of improving soil health.”

The ICP report showed that over the last year landowners helped prevent over 1.6 million tons of sediment, over 3.6 million pounds of nitrogen and over 1.8 million pounds of phosphorus from entering Indiana waterways.

In the fall of 2022, and emerging in the spring of 2023, Hoosier farmers planted more than 1.6 million acres of living cover, which includes cover crops and winter wheat. Cover crops and no-till practices implemented with ICP's assistance sequestered an estimated 41,000 tons of soil organic carbon, which is the equivalent to the carbon emissions of more than 30,168 cars.

While the term conservation practices can mean many things, in Indiana, some of the most common conservation best management practices are cover crops, nutrient management, residue and tillage management, conservation cover, early successional habitat development/management and grassed waterways.

“Indiana’s vitality is rooted in the soil. In a time when extreme weather events are inevitable, keeping our soil healthy and productive is of paramount importance,” said Indiana Natural Resources Conservation Service (NRCS) State Conservationist Damarys Mortenson. “We are seeing great strides by our Indiana farmers who are working with the ICP to incorporate soil health principles on their land. These producers are increasing their soil’s organic matter, reducing the need for expensive inputs and improving microbial activity — all while harvesting better profits and often better yields.”

Indiana State Department of Agriculture Director Don Lamb congratulates Hoosier farmers and landowners on another record year.

“It is exciting news to share that Hoosier farmers and landowners continue to break records each year on installing soil conservation practices,” said Lamb. “A large key to this success is helpful partnerships, having the right tools available and having willing participants. I want to thank the Indiana Conservation Partnership team for their efforts and of course our farmers and landowners who want to keep their soil healthy and thriving for years to come.”

The ICP is made up of public and non-profit groups, along with landowners, that work together for the betterment of soil health and water quality. ICP organizations include, Indiana Association of Soil and Water Conservation Districts, Indiana Department of Environmental Management, Indiana Department of Natural Resources, ISDA, Indiana State Soil Conservation Board, Purdue Extension, USDA-Farm Service Agency and USDA-Natural Resources Conservation Service.

The Indiana Conservation Partnership is a crucial part of Indiana’s Nutrient Reduction Strategy, this illustrates the continued success and challenges of conservation and serves as a tool to help set watershed priorities and reduction targets, manage conservation resources and to further stakeholder involvement across Indiana.

To find more information on soil and water conservation in Indiana, soil and carbon sequestration, soil conservation trends, Indiana’s work in our three water basins or partnerships between other states in the full report, click here or visit isda.in.gov.

SalemLeader.com

Leader Publishing Company of Salem, Inc.

P.O. Box 506

117-119 East Walnut Street

Salem, Indiana. 47167

Phone: 812-883-3281 | Fax: 812-883-4446

Business Hours:

Mondays through Fridays, 9:00am - 5:00pm

News:

news@salemleader.com

Office:

office@salemleader.com

Publisher:

publisher@salemleader.com

Business

- More Business News

- Go To Guide

- Business Directory

- Auctions

Education

- More Education News

Opinion

- Editorials

- Letters to the Editor

- Columns

- Unsung Heroes

- Days Gone By

- In the Garden

- Guest Columns

- Reader's Poll

- Salem Leader Forum

- Questions and Answers

Church

- Bible Aerobics

- Church News

- Church Directory