RRDA Opening Jim Lewis Avenue at State Road 62 with New Traffic PatternIntersection Improvements Expected to be Fully Completed in the First Quarter of 2025Charlestown, IN (December 5, 2024) – River Ridge Development Authority (RRDA) announced today it is preparing to open the Jim Lewis Avenue intersection at State Road 62 in the coming months with a new traffic pattern on SR62. This project marks an important milestone in infrastructure improvements to serve new businesses and their employees within the River Ridge Commerce Center (RRCC).As part of ongoing development, the “Green T” intersection project is expected to be fully completed in the first quarter of 2025. In the interim, the intersection will open to allow traffic flow, but without signalization. Drivers will have the ability to turn right into and out of Jim Lewis Avenue at the intersection at SR62, but left turns will be temporarily restricted until the project is finalized.Additionally, upgrades are underway at Miami Trail with installation of a four-way, signalized intersection. This critical improvement aims to enhance connectivity and streamline traffic flow into Dan Cristiani Excavating’s Shadow Lake development and into the RRCC. This project will also complement the additional infrastructure enhancements at Jim Lewis Avenue.“The opening of the Jim Lewis Avenue intersection demonstrates our commitment to improving transportation infrastructure for our businesses while prioritizing public safety for their employees and residents in the area,” said Jerry Acy, Executive Director. “We appreciate the community’s patience and cooperation as we work to deliver these upgrades.”The “Green T” intersection is designed to enhance traffic flow and reduce congestion, improving access and safety for all road users. Once complete, the project will include new signalization, lane configurations, and enhanced signage to support smooth navigation.For more information about the design and functionality of the planned “Green T” intersection, visit the Indiana Department of Transportation website athttps://www.in.gov/indot/traffic-engineering/green-t-intersection/."We are excited to see the positive impact this project will have for residents, commuters and businesses in the area," said Chris Jackson, President of Dan Cristiani Excavating Co, Inc. "These changes will serve the community well for years to come, setting a foundation for future investment."Charlestown city officials also highlighted the importance of these improvements for the community. “These upgrades represent significant progress in making Charlestown more accessible and safer for our residents and visitors,” said Charlestown Mayor Treva Hodges. “We’re proud to see investments like this taking shape, proving once again there has never been a better time to choose Charlestown.”Residents and commuters are encouraged to stay updated on the project by visiting RiverRidgeCC.com for announcements and real-time updates.

Lawsuit alleges these corporatists are illegally conspiring to manipulate energy markets.

Attorney General Todd Rokita is taking further action to stop woke corporatists and their left-leaning allies in government from driving up energy costs for hardworking Hoosiers.

“We’re taking on very powerful forces arrayed against the interests of everyday working Hoosiers,” Attorney General Rokita said. “Coal has been the backbone of Indiana’s economic success for decades. The demand for electricity has gone up and these ESG titans are reaping the benefits of these skyrocketed prices; by keeping their thumb on production.”

ESG investing — the acronym stands for the investing principle that prioritizes environmental issues, social issues, and certain corporate governance ideas — elevating goals like mitigating climate change, enforcing hiring quotas, and achieving social justice benchmarks above the fiduciary duty to maximize returns for investors.

Over the past four years, America’s coal producers have not been responding to the price signals of the free market, but have been listening to BlackRock, Vanguard, and State Street instead as alleged in the complaint. The three asset managers acquired substantial stockholdings over several years in every significant publicly held coal producer in the United States, thereby allegedly gaining the power to control the policies of coal production in the United States.

Indiana along with 10 other fossil fuel producing states filed suit to hold BlackRock accountable for their alleged aggressive attempts to manipulate policy by manipulating and controlling the markets through threats and votes at stakeholder meetings and in board rooms. As unelected non-policy makers, the complaint alleges they are using their market power to force socialist and Leftist policies, like climate change, to better fill their pockets.

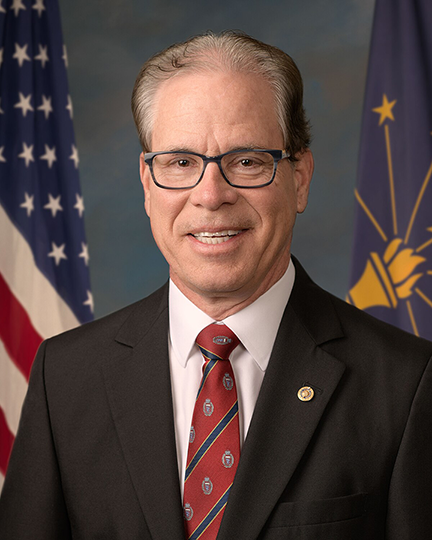

Governor-elect Mike Braun unveiled his Freedom and Opportunity Agenda today, a comprehensive framework designed to take Indiana to new heights through targeted reforms and strategic investments.

"Our Freedom and Opportunity Agenda represents a bold vision for Indiana's future," said Governor-elect Braun. "By implementing these common-sense solutions, we'll create a more prosperous, safer, and stronger Indiana for every Hoosier family."

The agenda prioritizes:

- Providing tax relief to address inflation and reduce the burden for everyday Hoosiers.

- Delivering a leaner, more responsive government that runs efficiently and provides excellent constituent services.

- Equipping Indiana’s next generation through education, workforce development, and economic development.

- Investing in a healthier Indiana by driving down healthcare costs, increasing access, and increasing transparency.

- Improving quality of life for every Hoosier through public safety, affordable energy, and clean water.

The agenda combines executive action, legislative initiatives, and agency-level reforms to achieve these policy goals. More details about each of these priorities are outlined below:

Historic Tax Relief for Hoosier Families

As Hoosiers contend with inflation, the State should provide comprehensive tax relief that protects taxpayers from runaway property taxes, supports retirees and families with targeted relief, and reduces the burden on Main Street businesses.

- Cap annual property tax increases at 2-3% to protect homeowners and farmers

- Cut property taxes by resetting homeowner bills to their pre-COVID levels

- Eliminate state tax on retirement income including pensions, 401(k)s, and IRA distributions

- Create tax-advantaged Farm Savings Accounts to help stabilize farm income

- Institute strategic sales tax holidays for back-to-school supplies, outdoor recreation equipment, and youth sports gear

- Update the farmland base rate formula to provide targeted relief for agricultural communities

Streamlined, Responsive Government

A leaner, more responsive government is better for taxpayers and the economy. Unlike the private sector, where real economics incentivizes effectiveness and lower overhead, government at every level has grown unchecked. To reduce waste and improve the delivery of essential services, the State should develop strict performance metrics for its agencies, and eliminate unnecessary or underperforming positions and programs.

- Consolidate state leadership into eight cabinet-level secretaries to improve efficiency

- Present a balanced budget that addresses the state's deficit while reforming Medicaid spending

- Launch comprehensive digital transformation of state services, including:

- Automated veteran healthcare eligibility verification

- Streamlined BMV document processing

- One-stop online portal for farmer services

- Conduct systematic review to eliminate outdated regulations and reduce administrative burden

Education Excellence and Workforce Development

Indiana’s future prosperity depends on educating and developing a skilled workforce ready to take on tomorrow’s challenges.

- Implement universal school choice for all Indiana families regardless of income

- Increase teacher base pay and establish performance-based compensation

- Enhance school safety through a new Office of School Safety

- Invest in workforce development through:

- Creation of the Hoosier Workforce Investment Tax Credit

- Restructured Indiana Economic Development Corporation

- Enhanced regional collaboration for job creation

- Focus on improved literacy and math outcomes with evidence-based curriculum

Healthcare Transformation

Rising healthcare costs and limited access to care, particularly in rural areas, continue to challenge Hoosier families and healthcare providers. This multi-faceted strategy addresses both costs and healthcare accessibility while promoting innovation in the industry.

- Drive down healthcare costs through:

- Enhanced price transparency requirements

- Reformed prior authorization processes

- Regulated pharmacy benefit managers

- Expand rural healthcare access through:

- New incentives for rural healthcare facilities

- Enhanced telehealth coverage

- Improved obstetrics access

- Protect coverage for pre-existing conditions

- Create Primary Care Access Revolving Fund to support new medical facilities

- Reform mental health treatment to reduce burden on criminal justice system

Enhanced Public Safety

Hoosier families and communities deserve to know that their safety and security are the top priority of the state government. In today’s interconnected world, national issues like illegal immigration and the flow of illegal drugs like fentanyl and methamphetamine have a real impact on communities across the state and country. Because of the complexity of modern public safety, it is imperative that the State supports our law enforcement officers in the line of duty.

- Support law enforcement through:

- Competitive salary and benefits packages

- Enhanced training opportunities

- Protected qualified immunity

- Establishing non-discretionary minimum bail requirements for violent crimes

- Combat drug trafficking through:

- Strengthened penalties for fentanyl and methamphetamine distribution

- Enhanced state police interdiction powers

- Comprehensive prevention and recovery programs

- Address illegal immigration by:

- Enforcing sanctuary city bans

- Enhancing cooperation with federal authorities

- Preparing Indiana National Guard for potential border support

Lower Energy Costs for Hoosiers

Over the last decade, Hoosiers’ electricity bills have increased dramatically, outpacing the national average. Indiana needs strong leadership to navigate these challenges and improve energy accessibility. The Braun administration will ensure that the State has enough affordable and reliable electricity to meet the needs of residents and attract new economic development.

- Ensure that Hoosiers always have access to affordable and reliable electricity and heat through:

- A comprehensive all-of-the-above energy strategy

- Cutting red tape

- Developing next-generation nuclear energy

The administration will immediately begin working with the Indiana General Assembly to advance these priorities during the upcoming legislative session.

"These reforms represent a comprehensive approach to Indiana's challenges," added Braun. "By implementing the Freedom and Opportunity Agenda, we'll ensure Indiana remains competitive while improving quality of life for every Hoosier."

The Freedom and Opportunity Agenda can be found at: www.brauntransition.com/wp-content/uploads/2024/12/Braun-Policy-Agenda12324.pdf

Learn more on the official transition website: www.brauntransition.com

Positive changes made to Indiana’s law as a result of investigation

Attorney General Todd Rokita has prevailed in a lawsuit against a Florida-based real estate company that negotiated contracts with Hoosiers that allegedly violated Indiana law.

After soliciting customers via thousands of robocalls, MV Realty unfairly locked Hoosiers into broker services contracts for a term of 40 years in exchange for modest up-front cash payments. Memoranda of these contracts were filed in each homeowner’s chain of title in county recorder offices — thus creating problems for homeowners who wanted to refinance, obtain second mortgages or undertake other transactions.

“Hardworking Hoosiers face burdens enough in financing housing costs without the added headache of dealing with deceptive schemes,” Attorney General Rokita said. “By successfully putting a stop to these predatory practices and voiding unfair contracts, we have spared hundreds of homeowners from difficult and unfair circumstances. Our team will continue our work protecting Indiana consumers.”

As part of a consent judgment, MV Realty and its principals have agreed to the following conditions:

- To file a release of all homeowner benefit agreements attached to the property of more than 300 Hoosier homeowners within 30 days of entry of the judgment.

- That MV Realty would relinquish all rights to the agreements and that they are void and unenforceable.

- That defendants would not advertise or offer services as real estate brokers or broker companies in the State of Indiana for at least five years.

Attorney General Rokita’s team will notify each homeowner of the settlement by letter. Any questions from consumers about the judgment can be directed to

In the lawsuit, the State of Indiana alleged that agreements with MV Realty signed by Hoosier homeowners were equivalent to high-interest mortgages, backed by the recording of the contracts against their real property. The resolution resolves more than $800,000 in expected future receivables for MV Realty, which have now been forfeited by the company.

Following Attorney General Rokita’s lawsuit against MV Realty, the Indiana General Assembly enacted legislation outlawing similar contracts.

Attorney General Rokita expressed gratitude to staff members who worked on achieving this successful resolution, including Deputy Director of Consumer Protection Steven Taterka; Homeowner Protection Unit Section Chief Chase M. Haller; Deputy Attorney General Jennifer Linsey; Homeowner Protection Unit Investigator Molly Jefford; and Data Privacy Investigator Victoria Hardcastle.

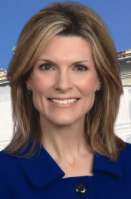

Steers State Financial Officers in National Debt Task Force

Indiana State Comptroller Elise Nieshalla is leading the effort to sound the alarm on the severity of the country’s debt burden as she initiated and chairs the National Debt Crisis Task Force comprised of 37 state financial officers. Their first key action was to send a letter to President-elect Donald Trump and members of Congress imploring them to develop and implement a long-term plan to restore the nation’s financial solvency.

“As Americans, we have hard truths to face,” said Comptroller Nieshalla. “The cost of interest alone on the nation’s $36 trillion debt carries a price tag larger than each of the annual budgets for Medicare ($839 billion) and the U.S. Military ($820 billion).”

Their letter urges immediate action to:

- Ensure total 2025 federal spending is less than in 2024;

- Implement a concrete plan to put the federal government on a path to a balanced budget as soon as possible; and

- Unleash economic prosperity by cutting red tape and tapping into our nation’s vast natural resources with a timeline for reducing the debt that is empowered by a growing economy.

Underscoring the massive scale of the problem, the state financial officers draw attention to the rate at which the national debt burden is increasing at $1 trillion every six months – contrast that with how it took the country 205 years to accumulate its first trillion in debt. Furthermore, they highlight the excessive spending of the federal government – $4.5 trillion was collected in tax revenue in 2023, but $6.3 trillion was spent.

The officers concur with Senate Resolution 600 and House Resolution 190 that declare the deteriorating federal financial situation is a “national security threat” and is “unsustainable, irresponsible and dangerous.”

“Successfully addressing this problem will be a marathon effort, and it must start now for the sake of the financial stability of our country and the states,” added Comptroller Nieshalla.

“The State of Indiana’s rock-solid financial foundation stands in stark contrast to the fiscal position of our nation. As Hoosiers, we have balanced budgets, well-funded pensions, healthy cash reserves and a AAA credit rating. In addition, Indiana is the seventh lowest debt per capita state in the country at $366, whereas the federal government’s debt per capita is over $100,000.”

Officers of the National Debt Crisis Task Force are pushing for the development and implementation of a fiscal recovery plan by 2026 when the country will mark the 250th Anniversary of the Declaration of Independence.

Comptroller Nieshalla states the overarching message of the letter, “We are asking President-elect Trump and Congress to make restoring America’s financial solvency a ‘Day One’ priority for the sake of our states and the country – our hard-won independence depends on it.”

To view the letter issued to all 535 voting members of Congress and President-elect Trump, see below.

SalemLeader.com

Leader Publishing Company of Salem, Inc.

P.O. Box 506

117-119 East Walnut Street

Salem, Indiana. 47167

Phone: 812-883-3281 | Fax: 812-883-4446

Business Hours:

Mondays through Fridays, 9:00am - 5:00pm

News:

news@salemleader.com

Office:

office@salemleader.com

Publisher:

publisher@salemleader.com

Business

- More Business News

- Go To Guide

- Business Directory

- Auctions

Education

- More Education News

Opinion

- Editorials

- Letters to the Editor

- Columns

- Unsung Heroes

- Days Gone By

- In the Garden

- Guest Columns

- Reader's Poll

- Salem Leader Forum

- Questions and Answers

Church

- Bible Aerobics

- Church News

- Church Directory